Why Ledger's partnerships are more effective than common Web3 collabs

Partnerships are the lifeblood and driving force behind a lot of Web3 growth.

And with good reason.

Most projects in this space are built around their community. By collaborating with an established and active community, you can seriously speed your growth in the space.

The thing is, many collabs aren’t just boring and unimaginative, they’re also pretty fruitless.

Ledger, the Web3 hardware wallet company, seems to have nailed their partnerships and collaborations, unlike others in the space.

Today, I’m examining what they do that’s so different so you can use the same tactics to speed your growth (even through troubled times…).

But first, who are Ledger?

Who are Ledger?

Ledger was founded in Paris in 2014 and has since grown to become one of, if not the most popular hardware wallet available.

They have 3 primary products which help users keep their crypto and digital asset holdings safe.

- Ledger Nano S

- Ledger Nano X

- Ledger Stax

All of which are some form of hardware wallet that helps better secure your assets.

Stax is an evolution of their other wallets as it has a more descriptive display so you can more easily approve transactions. A nice evolution which brings it more in line with modern mobile device functionality.

I do wonder how long it will be before someone builds a basic app that offers this functionality through your phone.

Funding

Ledger has received a substantial amount of funding totalling $577M.

It's a lot of funding for any industry, and a notable amount for Web3.

It's no wonder they’re one of the most well-known hardware wallets in Web3. Few brands have been around for close to a decade in this space, fewer still have raised this amount.

Monetisation and pricing

Of course those investors are going to want a return on that investment, and Ledger has one primary source of revenue.

The cost of their physical products.

You can download the Ledger Live app (ledger’s app for checking your portfolio and holdings) whether or not you have a Ledger hardware wallet, but you get full functionality by buying one of the wallets listed above.

At the time of writing, Ledger’s pricing of the products is…

- Ledger Nano S - £69

- Ledger Nano X - £136

- Ledger Stax - £249.99

Functionality between the Nano S and Nano X is similar. They have the same product design and the same basic functionality.

The Nano X offers more in the way of compatibility with other devices (particularly smartphones) thanks to the bluetooth functionality.

But really, there’s little between the two.

The Stax offers far more as it has a touchscreen. So the UX is going to be better, but really, the key functions are the same between all three.

It’s simply a 2FA method of sending funds which is way more secure than relying on a hot wallet like MetaMask.

Reviews

The review so the Ledger products are, generally, quite positive.

People milk the product and build quality. They obviously like the extra security they offer.

And so a lot of the reviews we see coming in here on DR are positive.

That might be changing though.

Recent Controversy

Ledger recently found themselves in hot water with a lot of the wider Web3 user base.

They recently announced something called Ledger Recover.

Long story short, Ledger is going to store user seed phrases for their wallets with trusted third-party companies.

A lot of existing ledger users believe this goes against Ledger’s focus on security. They’re effectively adding another link to the chain which is another potential avenue for hackers ot gain access to seed phrases.

And if someone has your seed phrase, they can get everything in your wallet.

Users are, understandably, pissed. Many are threatening to leave Ledger for other brands. A quick search on Twitter will uncover countless Tweets like the below.

Ledger is doubling down on this as, they believe, this is something future customers want. They’re trying to make security of crypto wallets and holding digital assets more accessible.

Which I 100% understand. I’ve often said that UX is one of the key problems stifling Web3 growth.

The average person doesn’t want a paper card with a 12 or 24-word seed phrase as their only source of wallet recovery. Most people outside of crypto struggle with the established c entralised methods for account recovery.

However, crypto maxis love this self-custodial approach.

I reckon a decent compromise would be for Ledger to release a separate product, maybe something like the Ledger Nano R which has the recovery option built in.

It could be the same as the Nano X in features and build, but just includes the third-party seed phrase security.

And that leaves the Nano X to be the self-custodial version.

I agree that UX needs to be easier for the average person, but compromising the security for existing users is also a risky move.

It's an interesting discussion which likely deserves a dedicated piece. So we’ll move on (let me know if you want to chat or see some analysis on this though).

Today we’re going to look at how Ledger runs their successful collabs. Let’s get into it.

The established norm for partnerships

Most partnerships and collaborations are a one-time deal or rely on single touchpoints.

Two partnership managers get in touch and they decide that they should work together.

If it’s a true collaboration, then partner A will refer users/community members to partner B. Partner B will return the favour by doing the same.

It looks a little something like the below.

It’s a simple exchange. The exchange can take several forms from a simple “check out what the folk At X are doing and subscribe/sign up to them here” to some form of co-branded event like a Twitter space.

You’re basically collabbing for exposure to the other brands’ audience and hoping they find what you offer interesting enough to sign up.

The other form of partnership that’s popular is basic affiliate deals.

Trezor (another popular hardware wallet) partnerships fall into this bucket. They have multiple forms of partnerships available on Trezor, but a lot of them fall into affiliate-like deals.

The three highlighted above on Trezor’s partnership page fall into this category.

You essentially work on your own offer and audience, but promote Trezor to those people.

Every time someone from your audience buys, you get a % of sales. If you’re really good, you can command a flat monthly fee for promotions.

It's less a partnership, and more the brand paying for exposure to established, potentially interested audiences.

The exchange here is simple. In addition to the access to the audience, you’re really buying access to the owner’s authority.

They’ve built trust with that audience and, any brand they promote then is seen as more trustworthy by that same audience.

And thanks to the nature of the deal, you only pay for actual customers they refer. Which makes this a very low-risk approach.

Generally speaking, affiliate arrangements aren’t all that successful for the brand.

Most affiliate deals offer between 10% and 50% of the revenue driven. And, according to Ahrefs, the revenue the affiliate ends up with is often less than $10k / year.

As you can see, it’s not a great way for you to drive revenue. I do think it can be great to get cheap exposure to audiences and increase brand recognition though.

If your brand shows up on the top 10 content producers in your industry, people are going to know who you are and come to check you out on their own.

The issue with this form of partnership

There’s a lot that has to go into one of these kind of campaigns. And it can be a difficult road to walk.

If you get these one-time partnerships to work well, you could be sitting on a gold mine. But there’s a few issues you need to be aware of.

The primary one is that, for many, they’re relying on a single promotion that’s a fixed point in time.

Whether an event or a simple “check out my friend X’s community” notification, you’re hoping that the audience both sees the promo and, for events, is able to make the time slot you’ve laid out.

In addition, you’re hoping that the audience being promoted to has a need and desire for your offer at the time they see the promo.

If all of that aligns, you're then just relying on your existing marketing to show people that your offer is worth their time.

When done well, it works really well and a single collaboration can massively speed the growth and awareness of your brand.

But referral marketing is a numbers game.

You’re going to have to run countless collaborations to find that one hidden gem that drives a lot of interest and users to your brand.

How Ledger improved upon this

By design or by fluke, Ledger have built a partnership system that creates longer-term gains for their brand.

Their approach is far more selective. It works in a way that turns each and every new user converted through the partnership into a potential advocate.

What I think is really smart is that Ledger are also hedging their bets. This more detailed approach to collabs is not their only method of promotion.

They still run a normal affiliate program…

… and do the regular event collabs you’d expect.

But they also have a far more selective collaboration system in place.

The short explanation is that they’re co-branding products.

This is super effective in Web3.

Ledger effectively steps out of the limelight and lets another brand with a large, vocal following take centre stage.

Let’s dive into this in more detail.

Why is Ledger’s co-branding approach an effective method on Web3?

Jump into Web3 Twitter or even LinkedIn and you’ll see PFPs that look like the below.

NFT communities are still huge. People who love a community want to show their support of it by using the NFT as their PFP.

This is still true throughout the downturn and lower interest in NFTs we’re seeing today.

When someone likes an NFT community or simply loves the artwork, they’ll represent them on social.

You’ll even have people promote and advertise for these collections without being asked to.

I’ve been in marketing for a long time, and I’ve never seen the level of buy-in, UGC, and user-led promotion of brands as I have with NFTs.

Good NFT communities are super active and can offer insane increases to reach and impact for the community.

Ledger obviously noticed this and thought about how they - as a physical product - could leverage that level of UGC.

The answer?

Co-brand with popular NFT projects and allow them to take centre stage.

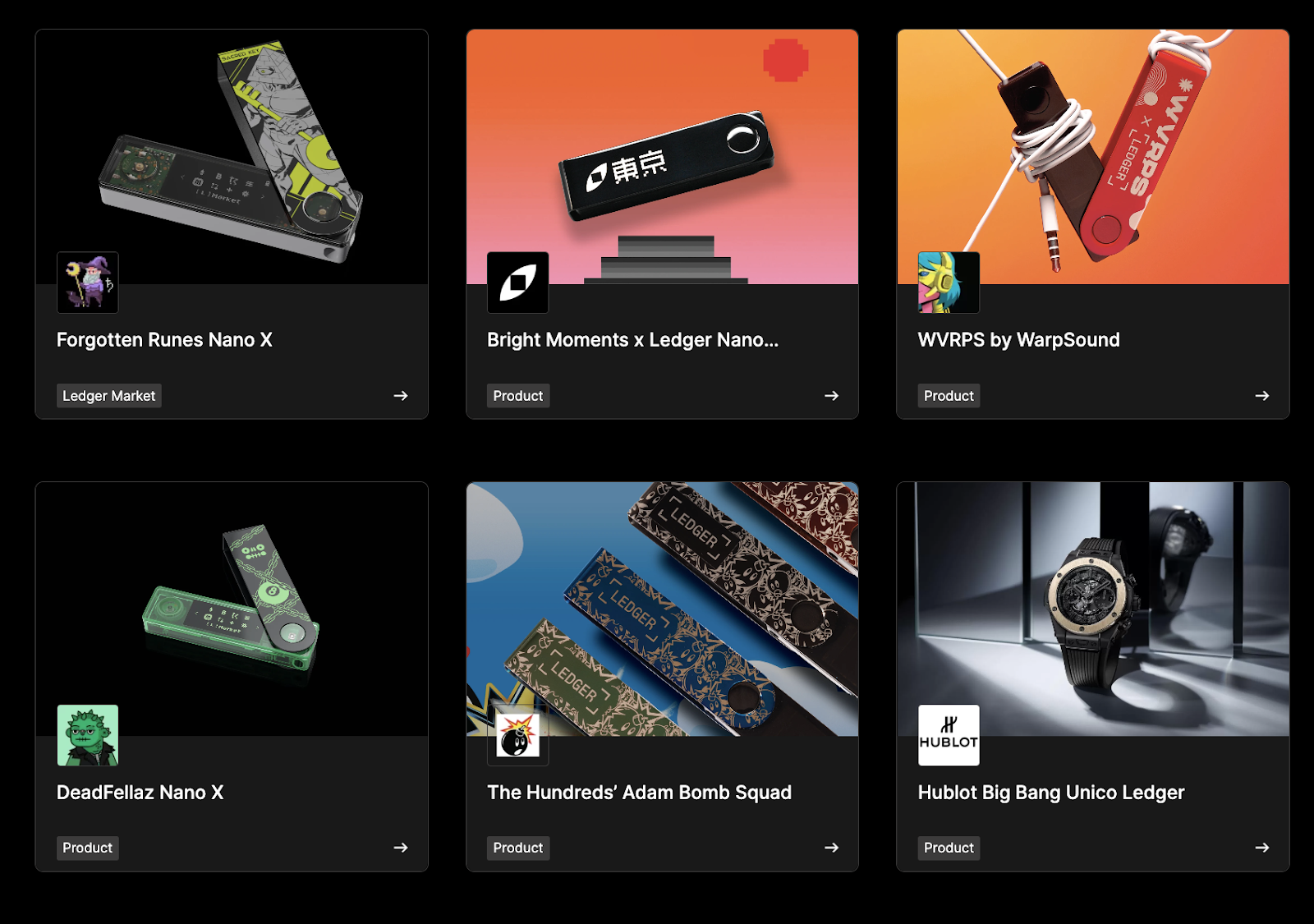

If you check out the Ledger collaborations page you’ll find a number of projects that have huge, active user bases that Ledger have partnered with.

They could have taken the basic approach to a collaboration.

Reached out to the community moderator or founders and ask if they could promote Ledger to the community for a fee.

It would likely work to drive some sales.

But Ledger wanted more. They wanted that UGC and buy-in from the community that a simple “get 20% off” wouldn’t achieve.

So they created specific Ledger products that allowed the community to have a hardware wallet showing what community they belong to.

Here’s the Deadfellaz Nano as an example.

This is smart for a couple of reasons.

One, you know the uptake is going to be pretty good. These users are proven to be super interested in the community they’re a part of, and they want to show who they support.

A specific design showing that allegiance will be a natural fit for people who buy NFTs for the designs and love to show which collections they’ve bought.

Also, co-marketing is so much easier.

You get direct access to the community and, thanks to the branding element, know you have something the user is likely to buy.

It means you're relying on far less than the other person/brands’ authority, trust levels, and effort to drive sales and engagement.

You’re simply leveraging their access to the community.

But there’s another benefit to this.

Unlike many collaborations that are a one-time deal done, effectively, behind closed doors. This kind of co-branding often leads to a lot of ongoing marketing results and avenues.

As mentioned, many of these community members love to show their allegiance and trust in the NFT community.

They share and overshare their thoughts, beliefs, and actions that could benefit the community.

When you hand them a product that has their favourite design and community emblazoned upon it, they take to social to quickly share their thoughts.

I mean, the Deadfellaz collab started in late 2022.

And if you look for messages around this you can see that people are still sharing a “check out my new Ledger” messages.

These promos persist as long as the partner collection/brand is alive and doing well. If they are, you can expect a lot of ongoing shares and visibility for no extra cost.

Each share is yet more brand awareness and potential referral traffic for Ledger.

They’ve effectively turned other people’s communities into advocates and influencer marketers for their brand without having to negotiate with each one or pay countless fees for ineffectual one-time posts.

It creates longer-term marketing strategy with more potential touchpoints across social. All of which refer back to the initial collab event sale.

And as social is one of the best ways to turn strangers into leads, this is a great way to dominate.

But it’s not as simple as many would think.

The problem with co-branding marketing strategies

This isn’t all sunshine and roses for Ledger.

There’s a lot that could potentially go wrong with this kind of approach.

The first major issue is in analysing which people to partner with.

Unlike the common collabs where it’s a share-for-share kind of exchange, you’re investing a lot of time, effort, and money into this kind of co-branding.

You need it to last.

NFT sales are low at the minute. There are signs of recovery, and you could argue things were artificially high through the boom, but overall sales are down.

If you’re putting time, effort, and money into a co-branding effort with an NFT collection, you need to make sure that the collection isn‘t going to disappear in a few months.

Ledger seem to have done a good job of this. They’ve obviously dug deep into projects to find those with longevity, great teams, and engaged communities.

It’s also likely the reason for the low number of collabs compared to their other collab approaches.

Which should also be mentioned as those other collab methods are a security against going all in on one method that has higher risk and cost.

It wouldn’t surprise me if Ledger used basic collabs with communities to identify their best fits.

A story for another time perhaps.

There’s also a huge reputation risk.

There are a lot of jokers and scammers in the NFT and crypto space.

While Ledger’s products are proven to be of good value and quality, by aligning themself with others they open themselves up to potential criticism from others in the space.

If they were to collaborate with a project that later turned out to be a rug pull or simple scam, you could bet your bottom dollar that Ledger would catch some flak for it.

There are some dedicated people out there like @ZachXBT who spend their time analysing the history of scammers (and who aren’t afraid to call people out).

And there are also plenty of others who will share their thoughts on who you’ve been aligned with in the past.

Whether or not you’re guilty of the scam, simple alliances with potential issues can bring you a tonne of negative press and potential headaches.

So you’ve got to be sure who you’re climbing into bed with.

Summing it up

Long story short, Ledger have done a great job of creating co-promotion campaigns that take their brand out of the limelight.

The result is getting their product into the hands of users more easily than existing collab models, and long-term benefits from UGC promotions they don’t have to pay for.

It's easier on the front end, and generates more passive long-term gains on the backend.

Win-win, but it’s not without its risks.

If you enjoyed this, I’d really appreciate your support.

Help us grow!

There are a few simple actions that would really help us grow Decent Reviews so I can do more of these studies and built an on-chain review system that removes the potential for botting, fake reviews, and paying to remove negative viewpoints.

Those are…

- Subscribe to the newsletter to help us out

- Share this piece with your friends who might be interested

- If you’re able, a tip would go a long way in helping us hire great talent to build out DR

And that’s it.

Cheers!

The information provided on DecentReviews does not constitute investment advice, financial advice, trading advice, or any other sort of advice. Do not treat any of the websites content as such. DecentReviews does not recommend that any cryptocurrency or blockchain asset should be bought, sold, or held by you. Conduct your own due diligence and consult your financial advisor before making any investment decisions.