CoinFLEX CEO claims ‘Bitcoin Jesus’ Roger Ver defaulted on $47m debt

CoinFLEX is having a rather public spat with Bitcoin investor Roger Ver. The long-time investor often dubbed Bitcoin Jesus, is said to be responsible for the exchange’s $47 million USDC debt, which led to a withdrawal freeze.

Following the stoppage of withdrawals on CoinFLEX, Mark Lamb, the CEO of the exchange, revealed that an investor’s account was suffering from negative equity. On this occasion, Lamb refrained from naming this investor.

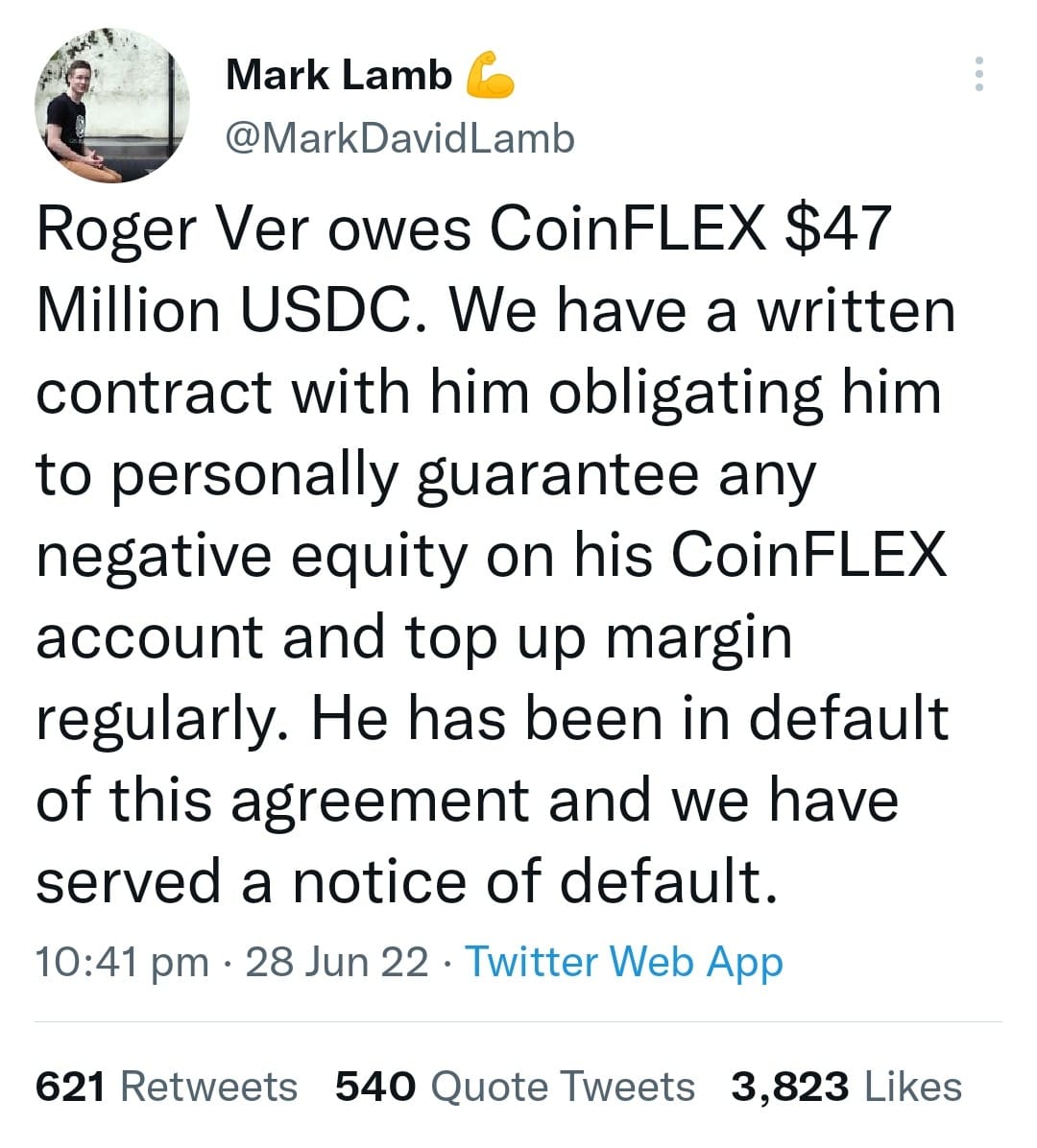

However, on Tuesday, Lamb revealed on Twitter that the investor was Roger Ver.

CoinFLEX withdrawal halt: What went down

Last week, on June 23, CoinFLEX had to halt withdrawals. The exchange gave an explanation that an investor’s account had “negative equity”. It turns out, that the investor had failed to pay $47 million USDC for a margin call.

Typically, in such cases, the exchanges automatically liquidate the position. However, CoinFLEX had a special agreement with the investor, so the position could not be liquidated.

More specifically, the exchange had “a written contract with him obligating him to personally guarantee any negative equity on his CoinFLEX account and top up margin regularly.”

On Tuesday, Mark Lamb took to Twitter and made allegations against Roger Ver. Here’s the full thread:

Lamb further explained that Ver had a long track record of meeting the margin requirements on time as the agreement demanded. The CoinFLEX CEO assured users that he wishes to resolve the issue at hand.

Meanwhile, Roger Ver has brushed off the rumors and claimed that CoinFLEX owes him money. In his tweet, he has deemed the allegations to be false, and said, “Not only do I not have a debt to this counter-party, but this counter-party owes me a substantial sum of money, and I am currently seeking the return of my funds.”

You can check out the full CoinFLEX review here.

CoinFLEX has issued a recovery token

Meanwhile, CoinFLEX is trying hard to damage the control. The exchange has rolled out a recovery token named ‘RvUSD’ and will give holders 20% yearly returns. The token is available to non-US residents and the subscription is capped at $100,000 per user.

RvUSD is being sold to sophisticated investors, that is, individuals with at least $1 million net worth. The subscribers also need to complete their KYC before investing in the token. Valued at $1 per token, there are $47 million RvUSD being issued. With this, CoinFLEX is trying to sell off the bad debt.

You might be interested in: FTX CEO Bankman-Fried says some smaller exchanges are “secretly insolvent”

The information provided on DecentReviews does not constitute investment advice, financial advice, trading advice, or any other sort of advice. Do not treat any of the websites content as such. DecentReviews does not recommend that any cryptocurrency or blockchain asset should be bought, sold, or held by you. Conduct your own due diligence and consult your financial advisor before making any investment decisions.